Understand and Optimize the Fees You Can't Negotiate

We analyze your interchange qualification and transaction routing to ensure you're not overpaying where it matters most.

700+

Ads Accounts Managed

$5M+

Ad Spend Managed

$10M+

Sales Revenue Generated

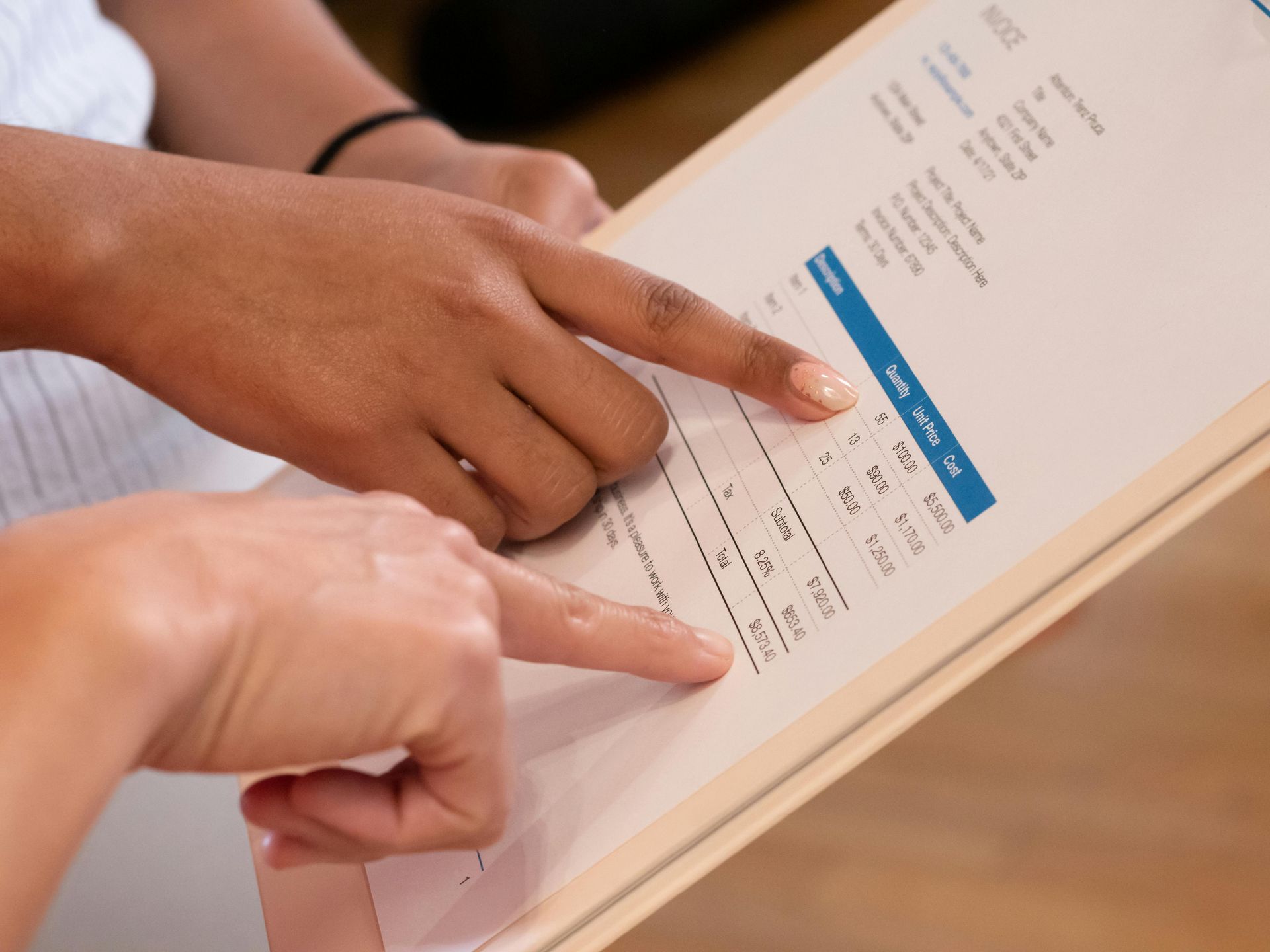

Interchange Fees Analysis

Interchange fees are often treated as fixed costs—but in reality, misclassification, improper data submission, and poor transaction routing can result in significant overpayment. Our team evaluates your interchange performance line by line and identifies what can be improved.

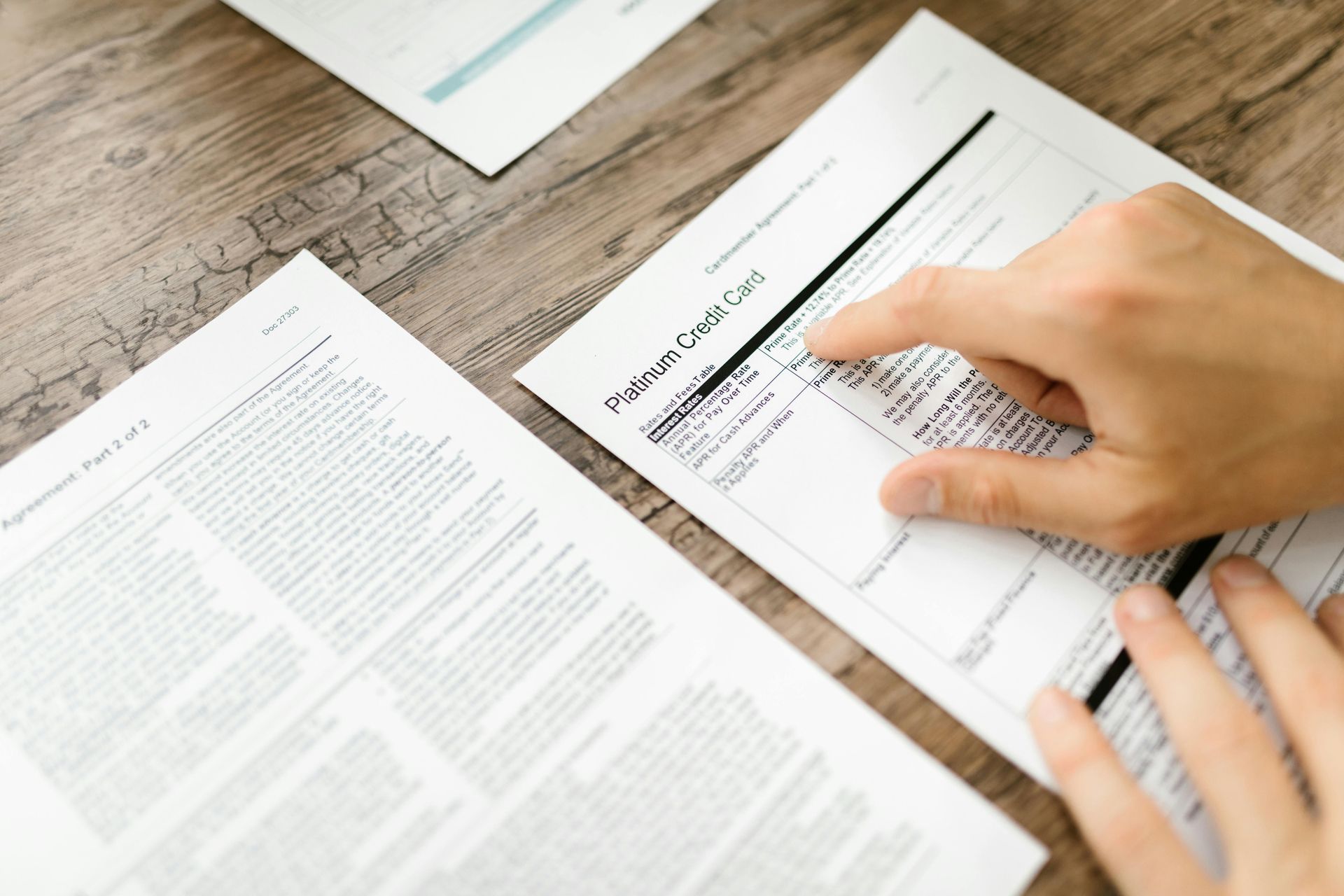

What Are Interchange Fees?

Interchange fees are set by card networks and vary by transaction type, card product, and merchant category code. While non-negotiable, they are highly sensitive to how data is submitted

How Overpayment Happens

- Incorrect MCC or SIC codes

- Missing Level II/III data fields

- Mismatched AVS or CVV inputs

- Improper transaction batching or timing

Our Interchange Audit Approach

- Review processor reports and statement line items

- Match transaction data to expected card network rates

- Highlight and quantify preventable downgrade fees

Optimization Strategy

We recommend simple but high-ROI changes to:

- Improve data enrichment in transactions

- Restructure transaction flow to align with best-qualified tiers

- Work with your processor or gateway to ensure data compliance

Why MG Partners?

We combine interchange benchmarking with deep technical and operational payments expertise. We don’t guess—we calculate.

What people say about us?

Don't just take it from us

Lena F. - VP Finance

"They saved us $80K just by fixing our AVS setup."

Raj N - CFO

"Finally understand why our corporate cards were costing us more."

David H.

"They translated interchange into plain English—and cut our cost per transaction."

FAQ

-

Are interchange fees really non-negotiable?

While the base interchange rates set by card networks (Visa, Mastercard) are generally non-negotiable for individual businesses, the markup your payment processor charges IS negotiable. More importantly, you can significantly lower costs by ensuring your transactions qualify for the best possible interchange rates, avoiding downgrades. "Optimizing interchange qualification for startups" offers real savings.

-

Why do I see downgrades on my statement?

Downgrades mean you paid a higher fee because a transaction didn't meet criteria for the best rate. Common reasons "payment processing downgrades happen to businesses" include:

- Not submitting complete data (like AVS/CVV for online sales).

- Missing Level II/III data for B2B transactions.

- Settling transaction batches too late. These issues lead to "unexpectedly high credit card processing fees for small businesses."

-

Can Level II/III data actually save money?

Yes, absolutely! For B2B sales, submitting detailed Level II and Level III data can significantly reduce your credit card processing costs. Card networks offer lower interchange rates for these data-rich transactions because they are seen as less risky. This is a key way "mid-market B2B companies achieve Level 3 savings."

-

How do I know if I’m overpaying?

Look for these signs you might be "overpaying for credit card processing as a mid-market company" or startup:

- Your "effective rate" (total fees ÷ total sales) seems high for your industry.

- You're on a complex tiered pricing plan instead of a more transparent Interchange Plus model.

- Your statement shows frequent "downgrades" or many unexplained fees.

- You process B2B payments but see no Level II/III optimized rates. A "merchant statement analysis for overcharges" can provide clarity.

-

Can I fix this without switching processors?

Often, yes. You can "optimize interchange fees without changing payment processor" by:

- Working with your current processor to ensure you're submitting all necessary data (AVS, CVV, Level II/III for B2B).

- Correcting batch settlement times.

- Requesting a review of your pricing plan and negotiating their markup. "Strategies to reduce payment fees before switching processors" can be very effective.