Stop Overpaying on Merchant Card Processing Fees.

Our consultants negotiate processor agreements that align with your volume, risk, and growth strategy.

700+

Ads Accounts Managed

$5M+

Ad Spend Managed

$10M+

Sales Revenue Generated

Negotiation with Processors

Your processing agreement dictates more than rates—it shapes your ability to grow and scale. We handle processor negotiations to reduce costs, tighten SLAs, and future-proof your agreements.

Why Negotiation Matters

Processors often default to broad, non-customized pricing that ignores your business’s scale. We change that.

Our Processes

- Analyze your existing contract and statement

- Define leverage points based on volume and risk profile

- Prepare talking points or negotiate on your behalf

Rate Improvement Benchmarks

Our average savings across clients exceeds 15% on total processing costs. We arm you with comparisons, not guesses.

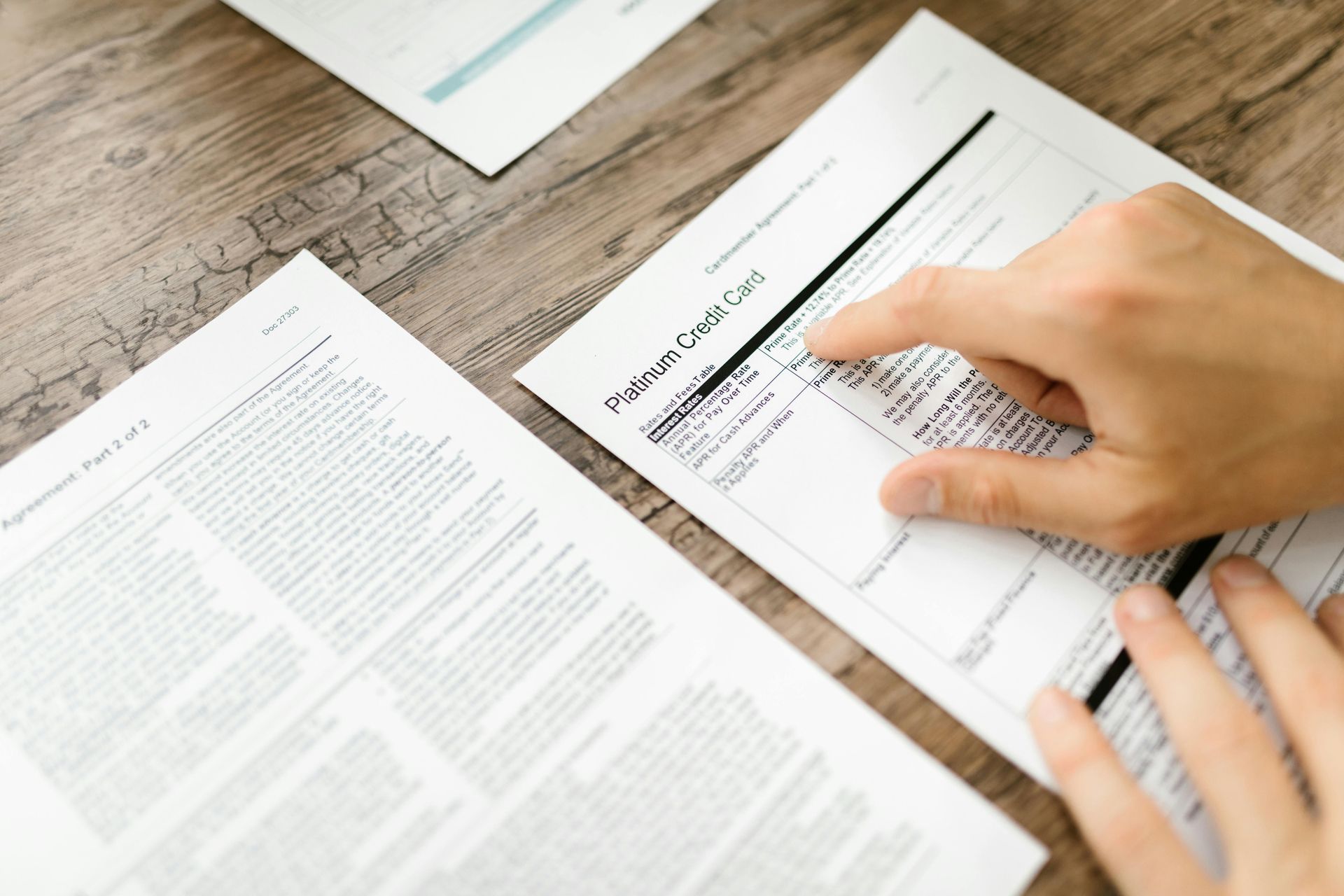

Contract Terms to Look For

- Early termination fees

- Downgrade triggers

- Daily vs. weekly funding options

Why MG Partners?

We’ve negotiated millions in fee reductions. We know where providers bend, and we push for long-term value.

What people say about us?

Don't just take it from us

Sarah L. - CFO

"They found $300K/year in duplicated gateway costs."

Michael P. - COO

"Our approval rate jumped 5% overnight."

Jenna W. - VP Payments

"Finally a team that speaks fluent payment tech."

FAQ

-

Can I renegotiate mid-contract?

Yes, it's often possible to renegotiate your payment processing contract mid-term, especially for growing startups and established mid-market businesses. While some processors might initially resist, factors like increased processing volume, a better understanding of competitive rates, or a clear presentation of how their current fees are above market can open the door to discussion. Success depends on your leverage and approach.

-

What fees are negotiable?

Many components of your processing fees are negotiable. The most significant are usually:

- The Processor's Markup: This is the percentage and/or per-transaction fee your processor adds on top of interchange and scheme fees.

- Monthly Account Fees: Also known as statement fees or service fees.

- Gateway Fees: If you use their payment gateway.

- PCI Compliance Fees: Sometimes negotiable or waivable if you demonstrate compliance through other means.

- Early Termination Fees (ETFs): Can sometimes be negotiated down or waived, especially if you're renewing or have leverage. Interchange rates themselves (set by Visa/Mastercard) are not directly negotiable with your processor, but ensuring you're on a transparent pricing model (like Interchange Plus) helps isolate the processor's negotiable portion.

-

Do I need a lawyer to review the contract?

While it's generally good practice to have a lawyer review any contract, it's not always a mandatory first step for understanding and negotiating the terms and fees within your payment processing agreement, especially when working with experienced consultants. Our team, with over 7 years of experience in this specific area, is adept at identifying unfavorable clauses, hidden fees, and restrictive terms that could impact your business. We can help you understand the financial and operational implications. However, for a comprehensive legal perspective covering all aspects of the agreement beyond just the processing terms and fees, or if particularly complex legal language is involved, consulting a lawyer remains a prudent option.

-

How long does this take?

The timeframe for a successful processor fee renegotiation can vary. It might take anywhere from a few days to several weeks. Factors influencing the duration include your processor's responsiveness, the complexity of your account and requests, how prepared you are with data and competitive insights, and the internal approval processes of the processing company.

-

What if my processor says no?

If your processor refuses to negotiate or doesn't offer competitive terms:

- Request a Formal Statement Review: Ask them to clearly justify all their fees and explain why they can't offer better rates.

- Gather Competitive Quotes: Obtain proposals from other payment processors. This will show you what's available in the market and can sometimes prompt your current processor to reconsider.

- Evaluate Switching Processors: If your contract allows or the potential savings outweigh any early termination fees (which you might also try to negotiate down), switching to a provider offering more favorable terms and transparent pricing is a strong option.

- Consult a Payments Expert: They can help assess the situation, identify leverage points you might have missed, or assist in finding a more suitable processing partner.