Uncover Hidden Fees in Your Payment Stack

We reverse-engineer processor statements to reveal hidden margins and help you renegotiate smarter contracts.

700+

Ads Accounts Managed

$5M+

Ad Spend Managed

$10M+

Sales Revenue Generated

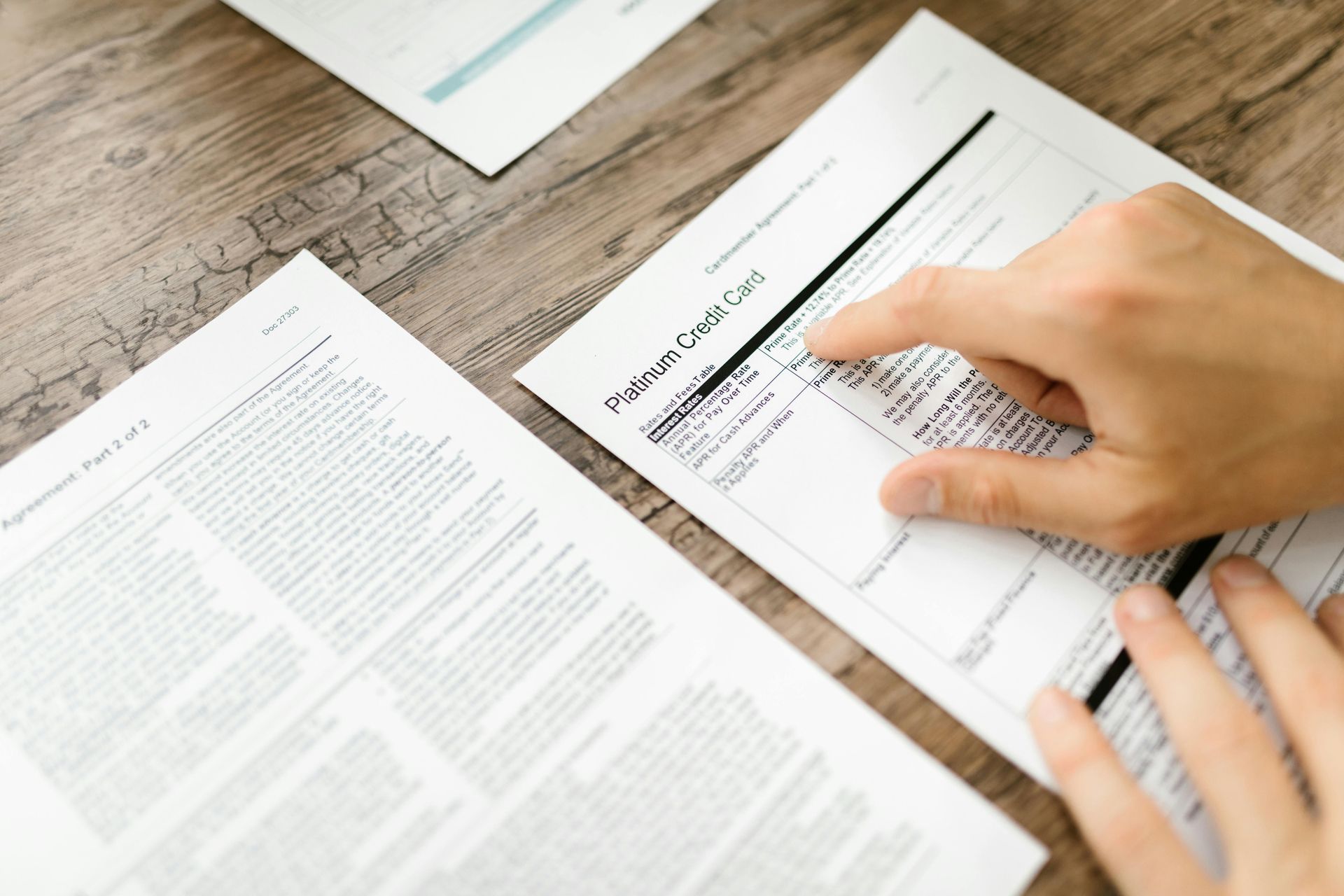

Processor Markup Evaluation

Many processors use obscure terms and bundled pricing structures to mask excessive markups. Our team uses forensic analysis to isolate base interchange from markup and uncover opportunities for margin improvement.

What Is Processor Markup?

Interchange fees are non-negotiable. Markups are not. Yet most businesses overpay due to opaque pricing structures and tiered plans. We break this apart.

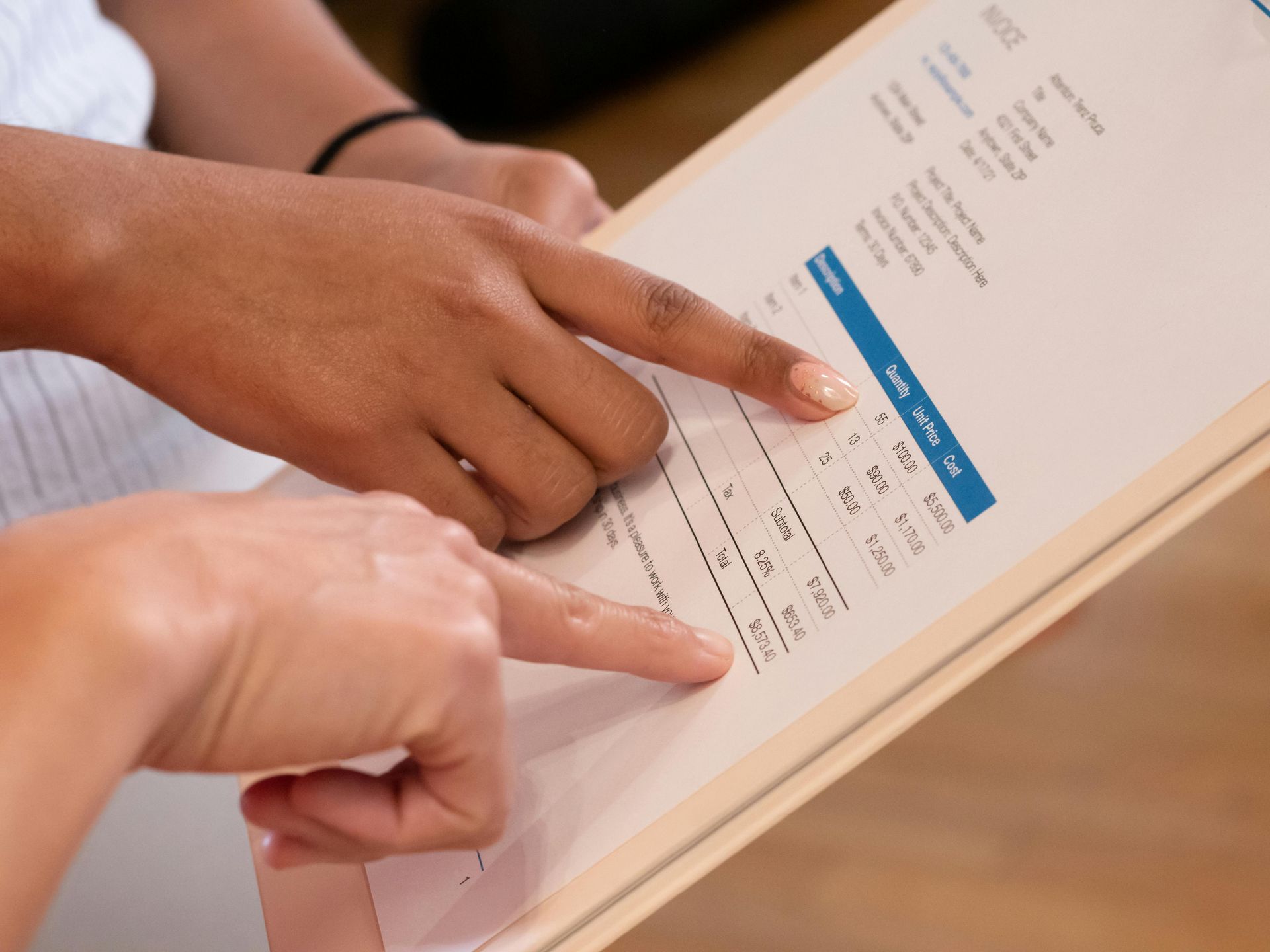

How We Identify Hidden Costs

- Effective rate calculation

- MCC and SIC misclassification analysis

- Surcharges and pass-through fees deconstruction

Real-World Fee Breakdown

Using tools and benchmarks, we show you how your effective rate compares to similar businesses. We identify overcharges from:

- Enhanced Data Level charges

- Batch fees

- Unexplained “miscellaneous” fees

Negotiation Insights

Our findings become the blueprint for negotiation or provider switching. With clean data, you have power.

Why MG Partners?

Our consultants come from inside the fintech industry. We know every code, markup layer, and contract trick—and we help you beat them.

What people say about us?

Don't just take it from us

Jim H - CFO

"They helped us claw back $250K in overcharges."

Natasha B - Finance Director

"We switched providers within a week after their audit."

Mike W - COO

"They know payment math better than the processors do."

FAQ

-

How long does a statement audit take?

An audit of your payment processor's fees and markup for a startup or mid-market business typically takes a few business days to a week after we receive your complete merchant statements (usually 1-3 months). The timeframe for analyzing processor fee structures for SMBs allows us to meticulously review all components of your bill, identifying the processor's specific charges beyond base costs.

-

What is a good effective rate?

A "good effective rate for merchant services including processor markup" will still vary by your business specifics (industry, transaction types, volume). However, when "benchmarking processor fees for growing companies," a lower effective rate (often aimed under 2.5% - 3.0%) often indicates a more competitive markup. The key is to understand what portion of your total fees is processor profit versus the actual cost of processing, which a "processor markup evaluation for SMEs" will reveal.

-

Can you work directly with our processor?

Yes, absolutely. As part of a processor fee negotiation service for businesses, we can work directly with your current payment processor to discuss and potentially adjust their markup and other assessed fees. The goal is to ensure you have a transparent merchant processing agreement with fair markups, and often, direct engagement is the best way to achieve this without you needing to switch providers immediately.

-

Do you recommend specific processors?

Our primary goal is to help you "understand and reduce your current processor's markup and fees." If, after a thorough "merchant services fee audit for your startup," it's clear your current provider's fee structure is uncompetitive or they are unwilling to adjust, we can then discuss what to look for in "choosing a payment processor with transparent fees." We guide you on finding competitive options rather than endorsing specific brands.

-

Will this affect our merchant account status?

No, a review of your processor's markup and service fees should not negatively impact your merchant account status. This type of merchant agreement fee evaluation for businesses is a standard practice to ensure fair and transparent pricing. It’s about understanding your contract and costs, not engaging in practices that would jeopardize your account.