How to Reduce Your Payment Processing Costs

Navigating the world of payment processors can be daunting. With so many options, how do you choose the right one?

Understanding payment processors is crucial for any business. They handle transactions, ensuring smooth and secure payments.

But not all processors are created equal. Fees, customer support, and integration capabilities vary widely.

Payment processing rates can significantly impact your bottom line. Knowing how to negotiate these rates is essential.

A payment processor negotiator can be your ally. They help secure better terms and lower fees.

Comparing payment processors involves more than just looking at rates. Consider the overall value and service quality.

Hidden fees can catch you off guard. It's vital to read and understand all contract terms.

This guide will equip you with the knowledge to compare, negotiate, and secure the best payment processing deals.

Understanding Payment Processors and Their Role in Your Business

Payment processors are the backbone of business transactions. They connect merchants, customers, and financial institutions smoothly.

Their main task is to handle transaction details. This includes authorizing, routing, and settling payments swiftly and securely.

Payment processors offer more than just transaction handling. They also provide essential services that support business operations.

Key benefits include:

- Fraud detection and prevention

- Secure data encryption

- Seamless integration with existing systems

- Access to detailed analytics

Choosing the right payment processor is critical. It influences not only operational efficiency but also customer satisfaction.

by hellooodesign (https://unsplash.com/@hellooodesign)

Processors vary in features, pricing, and support. Select one that aligns with your business needs and growth plans.

The right processor enhances customer trust. A smooth payment experience encourages repeated purchases and boosts loyalty.

Ultimately, your chosen payment processor can significantly affect your financial health. Therefore, understanding its role is vital.

Payment Processor Comparison: Key Factors to Evaluate

Not all payment processors are created equal. When comparing options, consider several critical factors that impact your business.

First, evaluate the fees involved. These include transaction fees, monthly fees, and setup costs. Understanding these will help you budget correctly.

Next, look at customer support. Reliable, 24/7 support can be a lifesaver during technical issues, ensuring minimal disruption.

Integration capabilities should also be assessed. Choose a processor that works seamlessly with your existing software.

Security features cannot be overlooked. Ensure the processor uses top-tier encryption and fraud prevention tools.

Key evaluation factors:

- Fees and costs

- Customer support availability

- Integration and compatibility

- Security measures

- Contract terms

by SumUp (https://unsplash.com/@sumup)

The contract terms, including length and termination conditions, should offer flexibility. Rigid contracts can trap you in unfavorable terms.

By carefully comparing these factors, you ensure a choice that aligns with your business goals. A well-chosen processor enhances your operations, providing growth and efficiency.

Pricing Models Explained: Flat-Rate, Interchange-Plus, and Tiered

Understanding pricing models is crucial. Each model affects costs in different ways, impacting your bottom line.

Flat-rate pricing offers simplicity. You pay a single fee for all transactions, easy to predict costs. This model suits small businesses with consistent sales volume.

Interchange-plus pricing adds transparency. Costs include interchange fees plus a markup. It provides insights into where costs arise and is ideal for those with varied transaction types.

Tiered pricing, however, divides transactions into categories, each with different rates. This model can be complex and may hide true costs.

Pricing models overview:

- Flat-rate: Simple and predictable

- Interchange-plus: Transparent and scalable

- Tiered: Complex with varying costs

by GuerrillaBuzz (https://unsplash.com/@guerrillabuzz)

Selecting the right pricing model depends on your business's transaction volume and type. Analyze your sales data to choose wisely.

Understanding these models ensures better decision-making, aligning with your financial strategies and ensuring profitability.

How to Analyze Your Business Needs Before Negotiation

Before entering into payment processor negotiation, it's vital to understand your business's unique requirements. Each business has different transaction volumes and payment methods, impacting processor selection.

Begin by analyzing transaction volume. Knowing your average monthly transactions helps identify the best pricing model for your business.

Next, consider the types of payments you accept. This includes credit cards, online payments, and mobile wallets. Different processors excel in different payment methods.

Evaluate your current fees. Understanding what you're paying now helps in negotiating better rates. Compare these with industry standards to identify potential savings areas.

Key points to analyze:

- Average transaction volume

- Types of accepted payments

- Current fees and costs

- Growth potential and scalability needs

Finally, consider scalability. If you anticipate growth, opt for a processor that can accommodate increased volume without major cost increases. Ensuring a processor aligns with these needs leads to a beneficial negotiation outcome.

Decoding Payment Processing Rates and Hidden Fees

Understanding payment processing rates is crucial for managing costs effectively. These rates directly impact your business's profitability.

Payment processors typically offer three pricing models: flat-rate, interchange-plus, and tiered. Each model has its advantages and drawbacks.

Flat-rate pricing is straightforward. It charges a fixed fee per transaction, regardless of card type or network.

Interchange-plus pricing offers transparency. It separates the interchange fee from the processor's markup, helping you see the exact costs involved.

Tiered pricing, however, can be opaque. Transactions are categorized into tiers, but exact fees can be unclear.

Hidden fees are a common pitfall. Watch for the following:

- Statement fees

- Batch fees

- PCI compliance fees

- Termination fees

by Shubham Dhage (https://unsplash.com/@theshubhamdhage)

These fees can significantly add to your monthly expenses if not managed properly. It's imperative to read all contract details and ask for clarity on any confusing terms. Thorough understanding empowers better negotiations and cost control.

Preparing for Payment Processor Negotiation: What You Need to Know

Preparation is key when entering negotiations with payment processors. Start by gathering detailed data about your transaction history.

Analyze your business's transaction volume and types. Knowing these helps you pinpoint your specific needs and leverage them during negotiations.

Consider the benefits of working with a consultant. These experts can provide insights and guidance based on industry experience.

Create a checklist to streamline your preparation:

- Review current contracts for termination terms.

- Evaluate your average transaction size and frequency.

- List all essential payment processing features needed.

- Identify areas where you're overspending.

Research other offers from competing processors. Presenting alternate options can strengthen your bargaining position.

Finally, establish clear negotiation goals, such as lower rates or added services. A focused approach leads to more successful outcomes.

Proven Strategies for Successful Payment Processor Negotiation

Effective negotiation requires strategy and planning. Focus on key areas to unlock better rates and terms.

One tactic involves showcasing your transaction volume. Processors often offer discounts for high-volume businesses.

Highlight your commitment to future growth. This reassures processors of ongoing mutual benefit.

Consider bundling services for potential cost savings. Processors might offer discounts if you use multiple products.

Research is crucial. Compare payment processors to identify your alternatives.

Use this information as leverage during negotiation:

- Present better offers from competitors.

- Highlight weaknesses in your current service.

- Emphasize your readiness to switch providers.

Avoid common negotiation pitfalls. Be wary of hidden fees and make them known

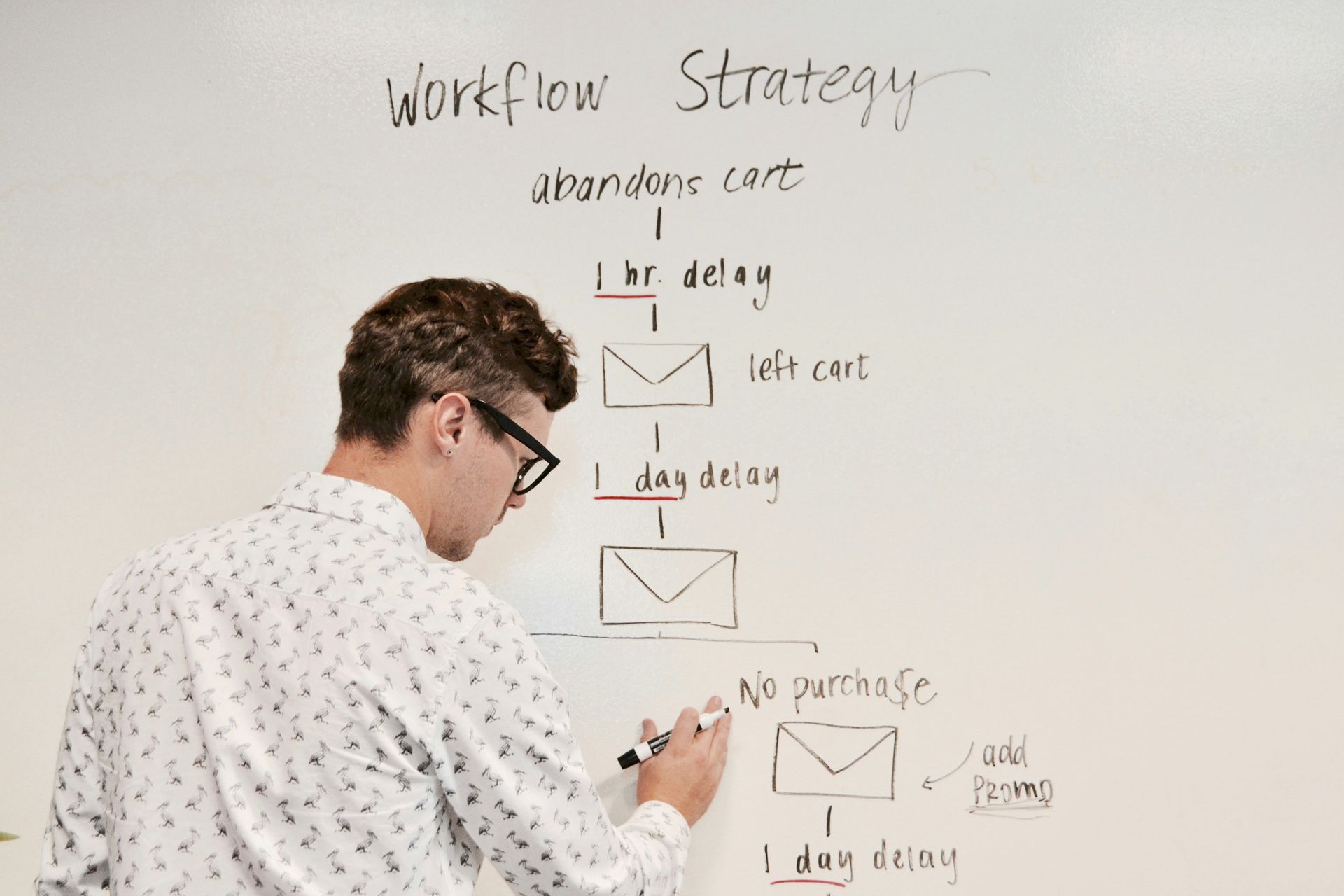

by Campaign Creators (https://unsplash.com/@campaign_creators)

Outlining your specific needs helps steer the conversation. Clear communication minimizes misunderstandings.

Leveraging Volume, Competition, and Data in Negotiations

Leverage is essential in any negotiation. Transaction volume is a powerful tool.

Consider these points when negotiating:

- Share your projected volume growth.

- Emphasize your loyalty and long-term commitment.

- Use competitive offers to press for better deals.

Understanding competition is equally vital. Knowing what other processors offer can bolster your position.

Data reinforces your arguments. Back claims with facts about your transaction statistics.

Negotiating Contract Terms: Length, Termination, and Flexibility

Contract terms can greatly impact cost and convenience. Aim for favorable arrangements in these areas.

Negotiate for shorter contract lengths. This keeps you flexible and responsive to market changes.

Push for low or no termination fees:

- Ensure terms are in writing.

- Clarify circumstances waiving fees.

- Explore costs of early contract exit.

Lastly, focus on contract flexibility. Adaptable agreements accommodate changes without penalties.

Flexibility ensures long-term savings and smoother operations. Contracts should serve your business interests, not just the processor's.

Preparing for Payment Processor Negotiation: What You Need to Know

Preparation is key when entering negotiations with payment processors. Start by gathering detailed data about your transaction history.

Analyze your business's transaction volume and types. Knowing these helps you pinpoint your specific needs and leverage them during negotiations.

Consider the benefits of working with a consultant. These experts can provide insights and guidance based on industry experience.

Create a checklist to streamline your preparation:

- Review current contracts for termination terms.

- Evaluate your average transaction size and frequency.

- List all essential payment processing features needed.

- Identify areas where you're overspending.

Research other offers from competing processors. Presenting alternate options can strengthen your bargaining position.

Finally, establish clear negotiation goals, such as lower rates or added services. A focused approach leads to more successful outcomes.

Using Payment Processor Comparison Tools and Consultants

Finding the best payment processor can be daunting. Comparison tools simplify this task by offering instant side-by-side evaluations. These tools highlight differences in fees, features, and services.

Using consultants adds another layer of expertise. They bring industry knowledge and negotiation experience. Their insights can uncover hidden fees or better rates you might miss.

Benefits of these resources include:

- Time-saving evaluations

- Expert insights and advice

- Comprehensive fee breakdowns

With the right tools and experts, choosing the perfect payment processor becomes manageable and strategic.

by Glenn Villas (https://unsplash.com/@glennvillas)

Case Studies: Real-World Examples of Negotiation Success

Learning from others’ experiences can provide valuable insights. Real-world case studies highlight successful payment processor negotiations. These examples showcase strategies that work.

One small business owner reduced fees by 15% by negotiating flat rates. They leveraged their transaction volume as a bargaining tool. The outcome included no hidden fees.

A mid-sized e-commerce company saved thousands annually. They switched from a tiered to interchange-plus model. This change resulted from a detailed fee analysis.

Lessons from these stories include:

- Understanding fee structures can lead to better terms.

- High transaction volumes can be a strong negotiation asset.

- Comparing pricing models reveals potential savings.

These examples demonstrate the potential gains from effective negotiation. They underscore the importance of thorough preparation and strategic approach.

Preparing for Payment Processor Negotiation: What You Need to Know

Preparation is key when entering negotiations with payment processors. Start by gathering detailed data about your transaction history.

Analyze your business's transaction volume and types. Knowing these helps you pinpoint your specific needs and leverage them during negotiations.

Consider the benefits of working with a consultant. These experts can provide insights and guidance based on industry experience.

Create a checklist to streamline your preparation:

- Review current contracts for termination terms.

- Evaluate your average transaction size and frequency.

- List all essential payment processing features needed.

- Identify areas where you're overspending.

Research other offers from competing processors. Presenting alternate options can strengthen your bargaining position.

Finally, establish clear negotiation goals, such as lower rates or added services. A focused approach leads to more successful outcomes.

Managing the Transition: Switching Payment Processors Smoothly

Switching payment processors can be daunting, but careful planning eases the process. Start by evaluating your current processor's services. Identify what your business truly needs.

Create a transition plan to avoid service disruptions. This includes ensuring data migration happens smoothly. Consider customer communications and any possible concerns.

Key steps to ensure a smooth transition:

- Backup all transaction data carefully.

- Communicate changes to your customers early.

- Test the new setup thoroughly before going live.

Preparation and clear communication foster a seamless transition. Avoid rushed decisions for optimal results.

Maintaining a Strong Relationship with Your Payment Processor

Building a good rapport with your payment processor can be beneficial. Regular communication ensures both parties are aligned. Address concerns promptly to avoid misunderstandings.

To maintain a positive relationship:

- Request regular updates on new features.

- Provide feedback on services received.

- Resolve disputes amicably and swiftly.

Engagement and open communication foster a healthy partnership. Anticipate future discussions by keeping relationships positive.

Staying Ahead: Trends and Innovations in Payment Processing

Keeping up with the latest trends is crucial in today's fast-paced environment. Innovations in payment processing can offer competitive advantages. Businesses need to stay informed about technological advancements.

Emerging trends include:

- Mobile and contactless payments

- Blockchain and cryptocurrency payments

- Enhanced security measures, like biometric authentication

by Nathana Rebouças (https://unsplash.com/@nathanareboucas)

Adopting these innovations can improve customer satisfaction and operational efficiency. Explore new tools to keep your business cutting-edge. Stay ahead by embracing change and innovation.

Conclusion: Maximizing Savings and Value Through Smart Negotiation

Successfully negotiating with payment processors can save your business significantly. By understanding the market and using strategic methods, you can secure better rates and terms.

Remember, a well-researched approach builds strong negotiations. Stay informed and proactive to keep your processing costs manageable. With the right strategies, you maximize savings while enhancing operational value.